ATO Tax Refund Cash Boost: $2,548 Average Refund for 2.6 Million Australians

More than four million Australians have already lodged their tax returns for the 2024–25 financial year with the Australian Taxation Office (ATO), highlighting increased interest in taxation and financial relief opportunities

Table of Contents

- Overview of Tax Refunds for 2024-25

- Pre-filling Income Information: What You Need to Know

- Understanding Tax Deductions: Maximizing Your Refund

- How Australians Plan to Use Their Tax Refunds

- Monitoring Your Tax Return and Refund Status

- Conclusion

- Frequently Asked Questions (FAQs)

Overview of Tax Refunds for 2024-25

Recent data from the ATO shows that as of July 31, over 2.6 million individual tax refunds have been issued, totaling more than $6.6 billion. The average refund issued stands at $2,548.

Despite the high volume of lodgements, millions of Australians have yet to submit their tax returns. Annually, approximately 14 million Australians lodge tax returns. The deadline to file is October 31, whether filing independently or through a registered tax agent.

For more information on lodgement deadlines and procedures, visit the ATO official website.

Pre-filling Income Information: What You Need to Know

Mark Chapman, Director of Tax Communications at H&R Block, advises taxpayers that while the ATO allows pre-filling of income information, this data may not be complete or entirely accurate.

“Many third parties, including banks, report information to the ATO later in the tax season, often in late July or early August,” Chapman explains. “Early lodgers using the ATO’s myTax system may find that some income data is missing from their pre-fill.”

Taxpayers must ensure all income is accurately reported. Omissions, even if based on pre-filled data, can lead to legal issues.

For guidance on using pre-filled information, refer to the ATO myTax guide.

Understanding Tax Deductions: Maximizing Your Refund

The ATO provides 40 industry and occupation specific guides to help taxpayers identify eligible deductions and the records required. Common deductions include:

- Work-related car expenses

- Travel costs for work purposes

- Tools and equipment necessary for the job

Items costing $300 or less are deductible immediately, while those costing more must be depreciated over several years.

Examples of deductible items are tools for tradespersons, laptops for office workers, and even handbags or briefcases used to carry work-related documents.

For detailed information on deductions, see the ATO’s Tax Deductions guide.

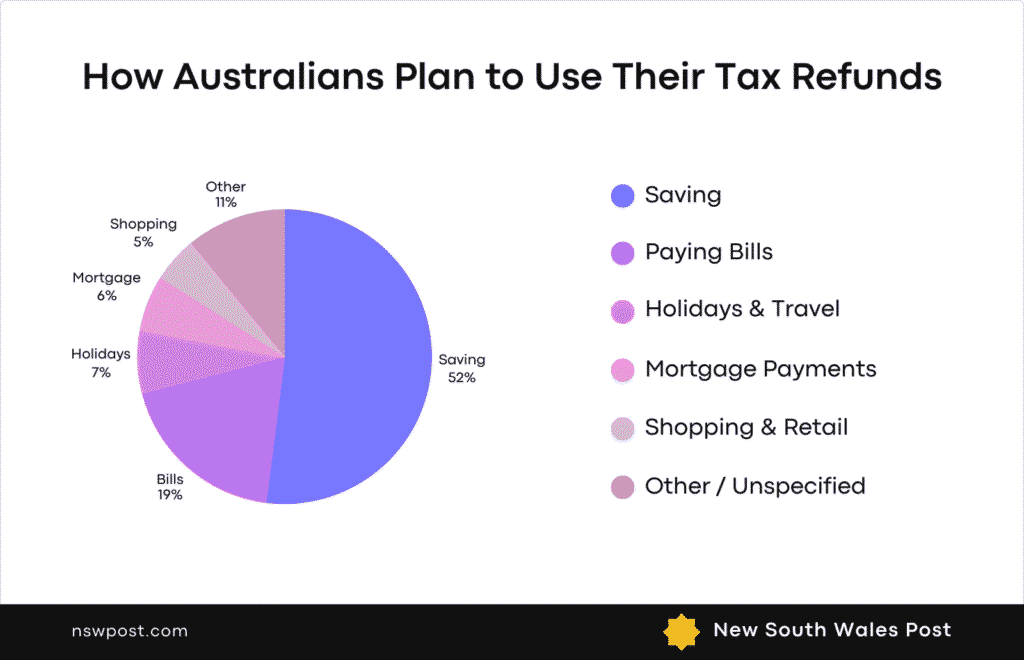

How Australians Plan to Use Their Tax Refunds

According to Finder research, 52% of Australians plan to save their tax refunds, prioritizing financial security. Additionally:

- 19% intend to use refunds to pay household bills

- 7% plan to fund holidays

- 6% will allocate funds to mortgage repayments

- 5% will use refunds for shopping or discretionary spending

Graham Cooke, Head of Consumer Research at Finder, comments, “It has been a challenging time for many households. Tax refunds provide essential financial relief and, for some, act as enforced savings.”

Read more about consumer spending trends at Finder Australia.

Monitoring Your Tax Return and Refund Status

Most tax refunds are processed within two weeks of lodgement. Taxpayers can check the status of their returns through the ATO app or the myGov portal.

For further assistance or inquiries, contact the ATO.

Conclusion

The 2024-25 tax season provides many Australians the chance to receive significant cash refunds, with an average of $2,548 so far. It is important to lodge your tax return accurately and on time, carefully review pre-filled information, and claim all eligible deductions to maximize your refund.

Frequently Asked Questions (FAQs)

Who is eligible to receive an ATO tax refund?

Any Australian taxpayer who has lodged a tax return and paid more tax than their actual liability is eligible for a refund. The refund amount depends on individual income and deductible expenses.

When is the deadline to lodge my 2024-25 tax return?

The deadline for lodging your tax return is October 31, 2025. If you use a registered tax agent, you may have an extended deadline.

Can I use the ATO pre-fill service to lodge my tax return?

Yes, the ATO pre-fill service can auto-populate income and other details from various third parties. However, ensure that all data is complete and accurate before submitting your return.

What are some common tax deductions I can claim?

Common deductions include work-related car expenses, travel costs, and tools or equipment necessary for your job. Items costing $300 or less can be deducted immediately, while higher-cost items may require depreciation.

How long does it take to receive my tax refund after lodging?

Most tax refunds are processed within two weeks after your return is lodged. You can track the progress via the ATO app or the myGov website.

Where can I find help or more information on lodging my tax return?

Visit the official ATO website or contact the ATO helpline for assistance. You may also consult registered tax agents or use tax preparation services like H&R Block.